Joint mortgage how much can i borrow

That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. In fact still having a traditional mortgage payments in retirement tends to hit seniors much.

How To Get A Joint Mortgage Comparewise

Some banks also offer mortgage loans up.

. The new borrower wouldnt have to apply for a new loan pay for closing costs or possibly risk paying higher interest rates. They can also assist you through the process of remortgaging and finding you the most affordable rates so if you need help with a joint mortgage after one person dies contact us today. At 60000 thats a 120000 to 150000 mortgage.

While your personal savings goals or spending habits can impact your. Available for loans between. Lets presume you and your spouse have a combined total annual salary of 102200.

With a 24- to 60-month loan you can pay off your card debt much quicker and for thousands of dollars less than if you only paid your minimum monthly card payment. To work this out they will look primarily at your annual income and outgoings to see what they think you can afford. The longer term will provide a more affordable monthly.

If you had a 10 mortgage deposit and were purchasing. If you cant save enough some mortgages let you apply with a guarantor instead of a deposit. Find out what you can borrow.

Forward or traditional mortgage payments represent a serious financial burden for anyone who has one whether for new homeowners still in the middle of their working lives or seniors in or nearing retirement. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. You can use the above calculator to estimate how much you can borrow based on your salary.

Your equity therefore is the difference between the market value of your home and the amount you. 31000 23000 subsidized 7000 unsubsidized Independent. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit.

Usually the amount of funding you can avail will be up to 60 of the registered value of the property. Use our first time buyer calculator to start the journey to your first home. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

However many kinds of. When it comes to calculating affordability your income debts and down payment are primary factors. Both Cosigners and joint borrowers are 100 responsible for the loan including the.

As part of calculating your mortgage we will ask how much money you have to put towards the deposit for your mortgage. Making sure your mortgage is affordable will benefit you and the lender in the long run. 700 credit score required.

For joint applications youll be eligible if at least one of you is a first time buyer. By default the table lists refinancing rates though you can click on the Purchase heading to see purchase money mortgages. Cosigning One borrower takes out the loan and owns the property it pays for.

Our mortgage calculators can give you a rough idea of how much you could borrow for your mortgage by. The minimum amount you would have to contribute is a 5 mortgage deposit so a 95 loan-to-value mortgage although this minimum may differ depending on what type of mortgage you are looking for. Determine how much you can afford in your new home.

This is a lenders way to calculate how much they are willing to let you borrow and if they think you can keep up with payments. Or 4 times your joint income if youre applying for a mortgage. Borrowers most commonly take.

Pros Cons No prepayment penalty. Total subsidized and unsubsidized loan limits over the course of your entire education include. Joint loan Borrowers take out the loan together and jointly own the property the loan pays for.

A mortgage loan is one in which you secure funds by pledging your property. Fixed-rate mortgages are the most common type of loan taken out by homebuyers and by homeowners remortgaging. How Much Mortgage Can I Afford if My Income Is 60000.

The usual rule of thumb is that you can afford a mortgage two to 25 times your income. Transferring a mortgage can simplify things. Now that you have your average monthly income you can use that to figure out your DTIs.

The cosigner has no right to the property but guarantees they will pay the loan if the primary borrower defaults. Had no ownership interest sole or joint in a residential property during the three-year period preceding the date of the purchase. A mortgage can be the most exhilarating but scary purchase youll make in your lifetime.

You can also input your spouses income if you intend to obtain a joint application for the mortgage. Factors that impact affordability. However in general you can deduct any mortgage interest that you pay on up to 750000 of debt any points you had to pay to get your mortgage or to pre-pay interest and any property taxes you pay.

Front end ratio is a DTI calculation that includes all housing costs mortgage or rent private mortgage insurance HOA fees homeowners insurance property taxes etc As a rule of thumb lenders are looking for a front ratio of 28 percent or less. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. The interest rates on mortgage loans range from 815 to 1180 pa.

With a fixed-rate mortgage youll pay the same interest rate for a set number of years meaning your monthly repayments will remain consistent regardless of what happens to the Bank of England base rate. The burden of a forward mortgage payment for retirees. How long will I live in this home.

Please get in touch over the phone or visit us in branch. We wont charge a fee for introducing you to the right broker theres no obligation and your credit report wont be affected. If you miss your mortgage payments your guarantor has to cover them.

Rather they make a down payment and then borrow the rest of the money in the form of a mortgage. Saving a bigger deposit. Current Redmond Mortgage Refinance Rates on a 260000 Fixed-rate Mortgage.

The following table highlights current Redmond mortgage rates.

Joint Mortgages Everything You Need To Know

Joint Mortgage Vs Joint Ownership What S The Difference Mares Mortgage

Joint Mortgages Everything You Need To Know

Can A Joint Mortgage Be Transferred To One Person Haysto

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

Joint Mortgage A Complete Guide Rocket Mortgage

What Is A Joint Mortgage And Should You Get One Dundas Life

Pin On Commercial And Residential Hard Money Loan In New Jersey

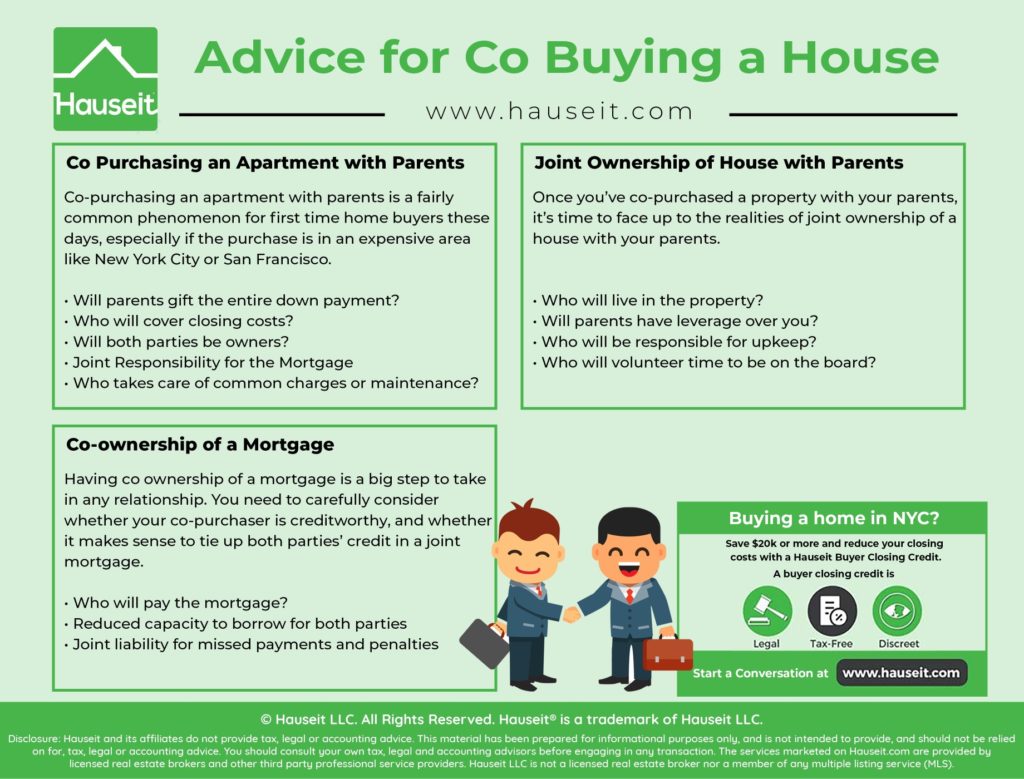

The Complete Guide To Co Buying A House Hauseit Nyc

Should You Get A Joint Mortgage Bankrate

Getting A Joint Mortgage When An Applicant Has Bad Credit Haysto

Buying Your Partner Out Of A Joint Mortgage Nuts About Money

What Is A Joint Mortgage And Should You Get One Dundas Life

.jpg)

What Is A Joint Mortgage And Should You Get One Dundas Life

Joint Mortgages With A Bankrupt Partner Haysto

What Is Joint Borrowing Bankrate

Joint Mortgages Should You Get One Lendingtree